#HARPOON THERAPEUTICS SERIES#

In addition to its contribution to Harpoon Therapeutics’ series C financing, OrbiMed has also made recent significant investments in Galetco Biotech, a developer of novel drugs to treat inflammation and fibrosis Terns Pharmaceuticals, a multinational biopharmaceutical company aimed at developing small molecule drugs to target cancer and liver disease and BELLUS Health, a biopharmaceutical company dedicated to developing novel therapies for diseases with a significant unmet medical need. The firm began spreading around the globe in 2007, opening offices in Shanghai, China San Francisco, California Mumbai, India Herzliya, Israel and Hong Kong. Harpoon Therapeutics, Inc., a clinical-stage immunotherapy company, engages in the development of a novel class of T cell engagers that harness the power of the.

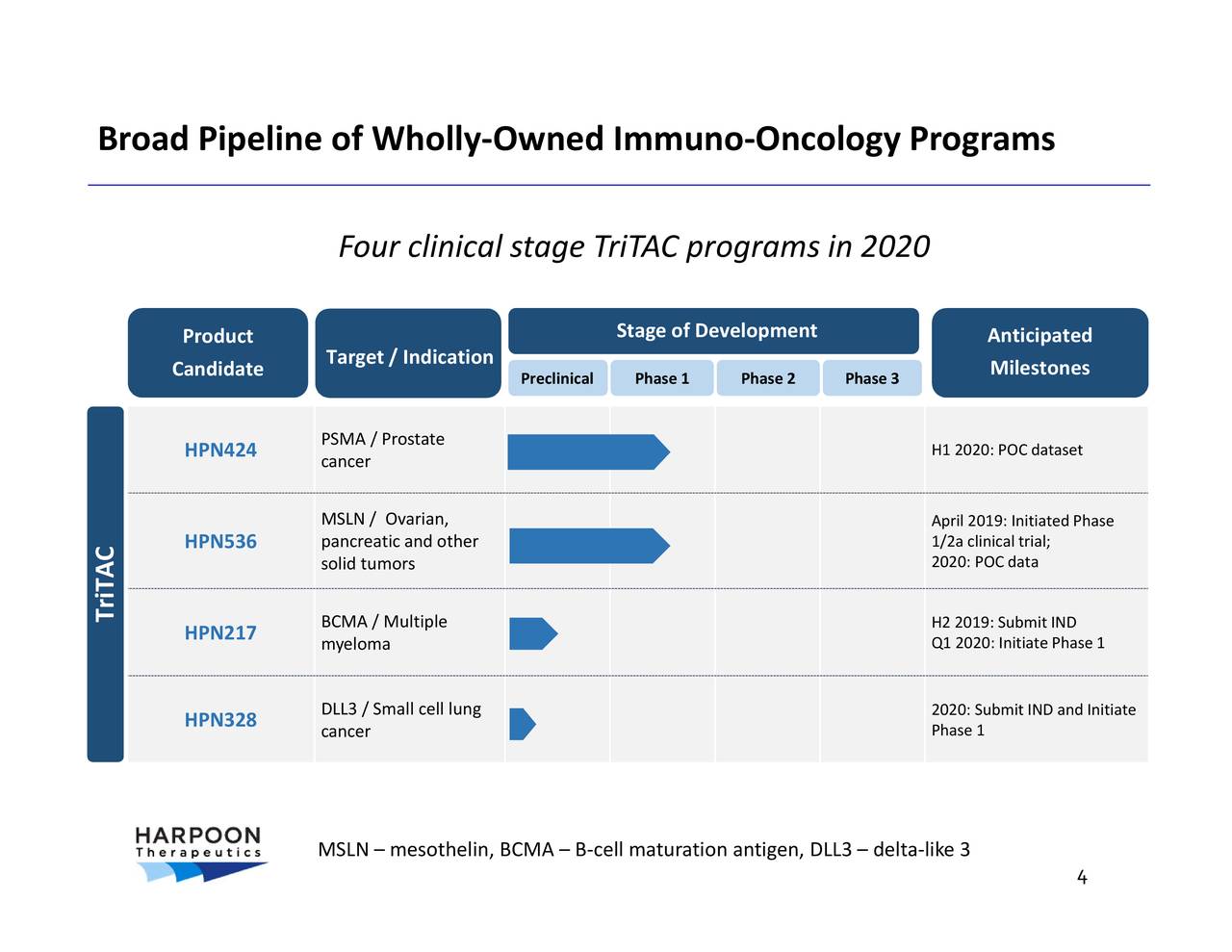

The health care fund’s portfolio ranges from huge multinational corporations to early-stage startup companies, and OrbiMed’s team of more than 80 professionals currently manages more than $14 billion in worldwide investments.įounded in 1989, OrbiMed launched its first long/short fund and made its first venture capital investment in 1993 its first devoted venture capital fund was initiated in 2000. Insiders who bought this year lost US50k as Harpoon Therapeutics, Inc. With this latest funding, OrbiMed adds to its 20-year track record of investment across the health care sector. Harpoon Therapeutics and Roche to Collaborate on Clinical Trials to Study Novel Immuno-Oncology Combination for Small Cell Lung Cancer. Harpoon Therapeutics’ leading product candidate is a drug designed to treat metastatic castration-resistant prostate cancer the drug, HPN424, is in the process of Phase 1 clinical trial. These platforms-which stand for Tri-specific T Cell Activating Construct and Protease-activated Tri-specific T Cell Activating Construct, respectively-are intended to use the immune system’s inherent power to effectively fight diseases such as cancer. CD3-targeted T cell engagers are potent anti-tumor therapies, but their development often requires management. Harpoon has earmarked the proceeds from its series C financing round for the further development of its existing immunotherapy programs founded on its TriTAC and ProTriTAC platforms. Harpoon Therapeutics, South San Francisco, CA. For Harpoon Therapeutics, Inc.

OrbiMed, a venture capital and private equity firm specializing in the health care sector, was the largest new investor. New investors also made significant investments in the company, including Ridgeback Capital Investments, Cormorant, NS Investment and Lilly Asia Ventures. Several of Harpoon’s existing investors contributed in this financing round, including New Leaf Venture Partners, MPM Capital, Arix Bioscience, Taiho Ventures LLC and Oncology Impact Fund. Harpoon Therapeutics is an immuno-oncology company which uses a proprietary technology platform focused on T cell engagement to discover and develop novel. Grundlggende analyse Harpoon Therapeutics: P/E, P/S, P/BV, P/FCF, EV/EBITDA, Nettogld/EBITDA, ROA, ROE, ROIC, ROCE, ROS, EPS, Vkstmargin, driftsmargin.

Harpoon Therapeutics, an immunotherapy company devoted to the development of T cell engagers, has announced that it has closed its $70 million series C financing round.

0 kommentar(er)

0 kommentar(er)